Millions of Dogs are at Risk When their Owners Pass Away

Millions of Dogs are at Risk When their Owners Pass Away

They say that a dog is for life. And, while this is true for most people, what happens if your furry friend outlives you?

There have been a number of headlines about the one per cent leaving millions to their surviving pets. In fact, there is a new Netflix documentary about a German countess who left her $80 million fortune to her German Shepherd, Gunter IV. While critics claim that this story is far-fetched, it got us thinking about the millions of dogs that will be vulnerable if their owners pass away without making a plan for them.

Understandably, for many, the very thought of leaving your beloved pet behind can be upsetting. But knowing that you have taken care of them in your final wishes can provide a sense of peace and comfort. So, how many dog owners have already made a plan for their dogs in their will? Read on to get the low-down.

The Figures at a Glance

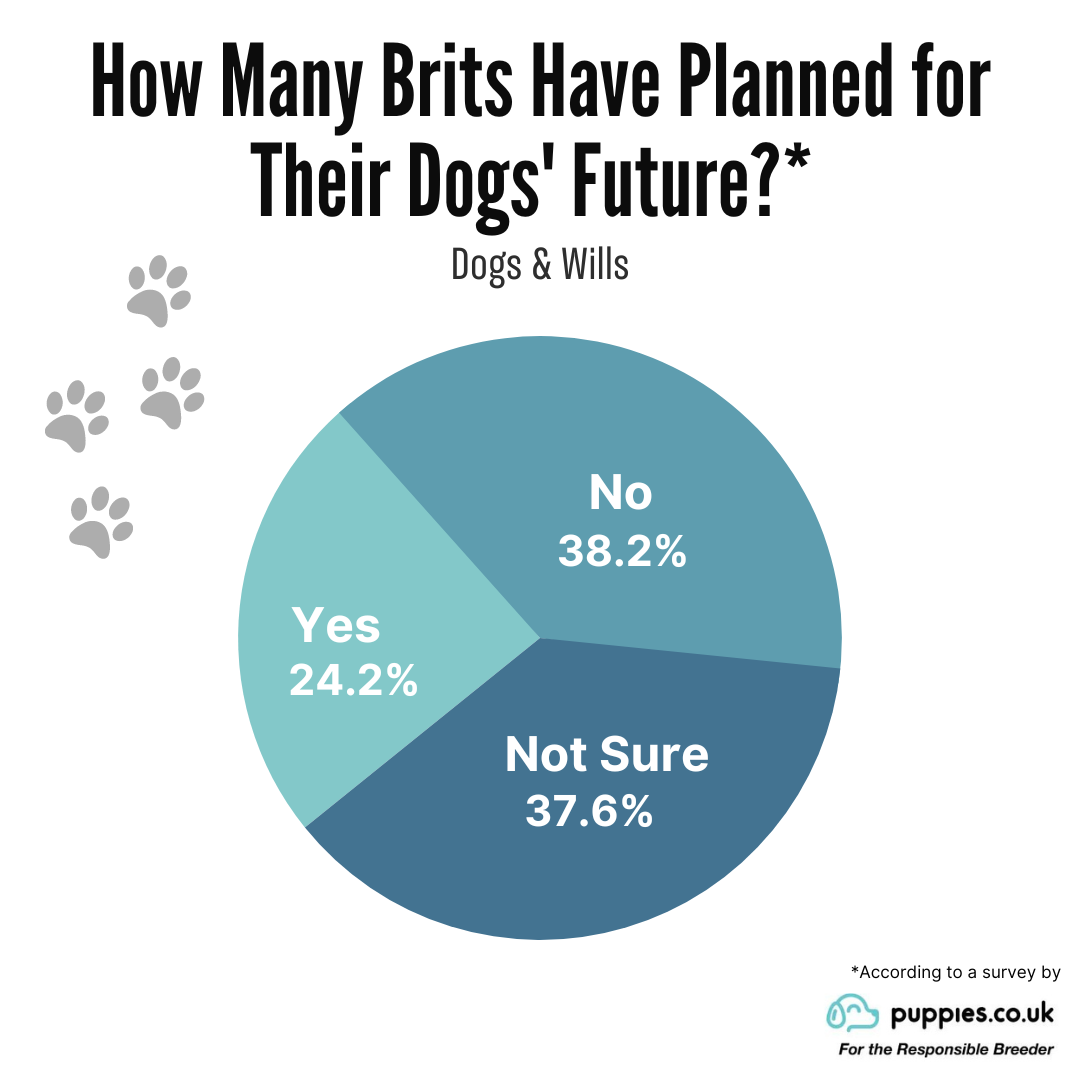

We asked dog owners whether they have planned for their pet’s future in their wills. Here is what we found.

76% of dog owners say they have not made a plan for their dog’s future

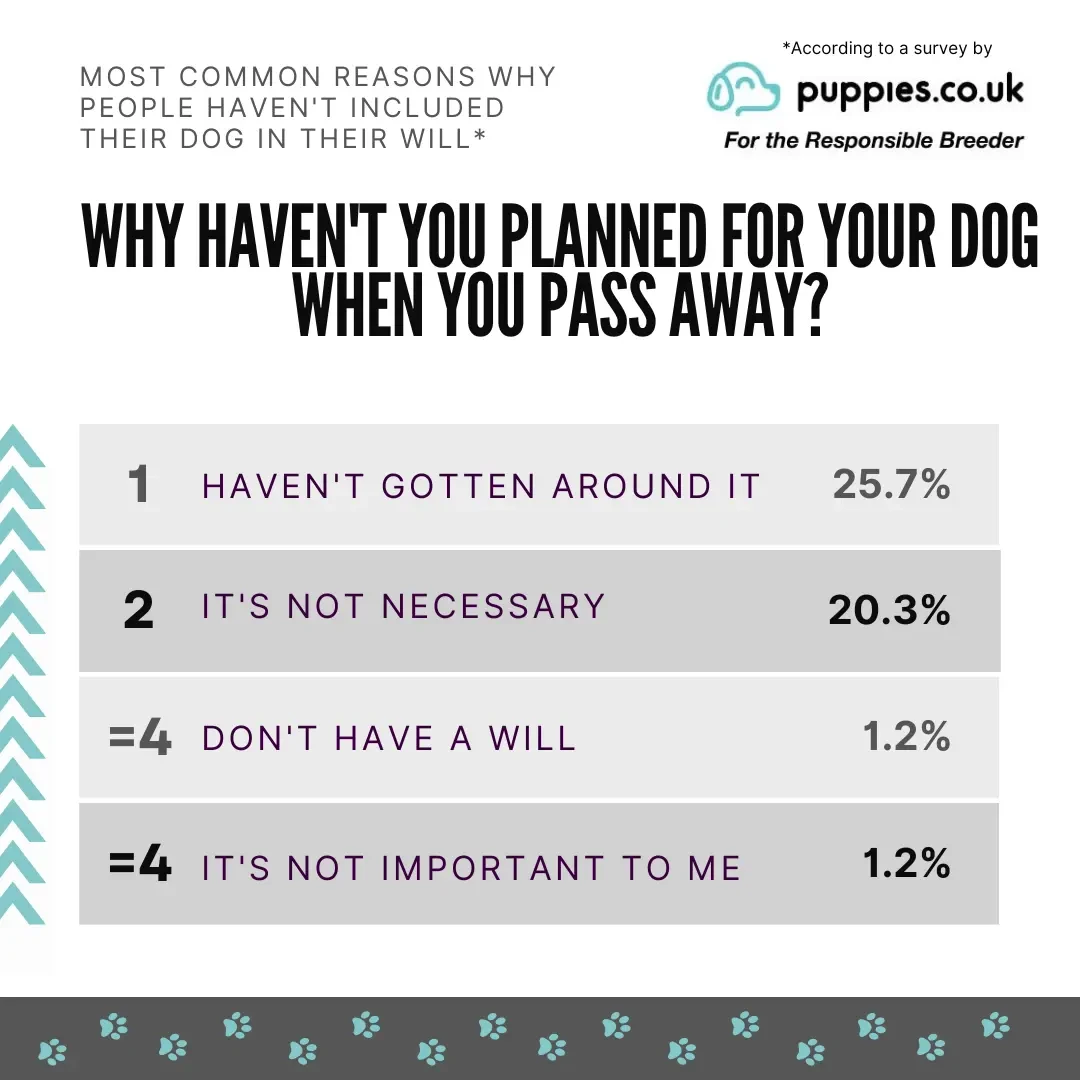

A quarter of puppy parents say they have not made a plan for their dog simply because they haven’t gotten around to it

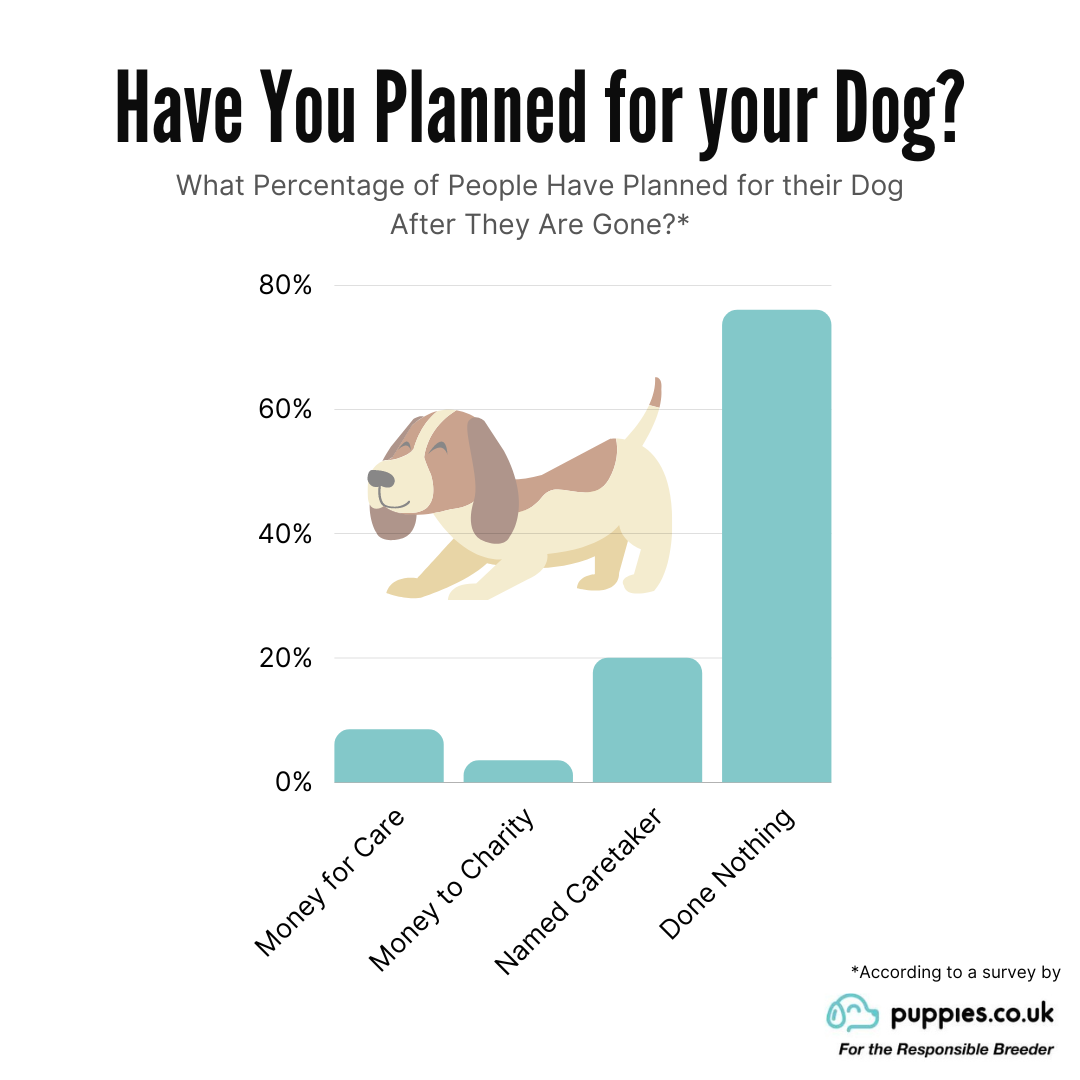

1 in 5 have chosen someone to look after their pooch and left money to ensure their pet’s quality of life is maintained

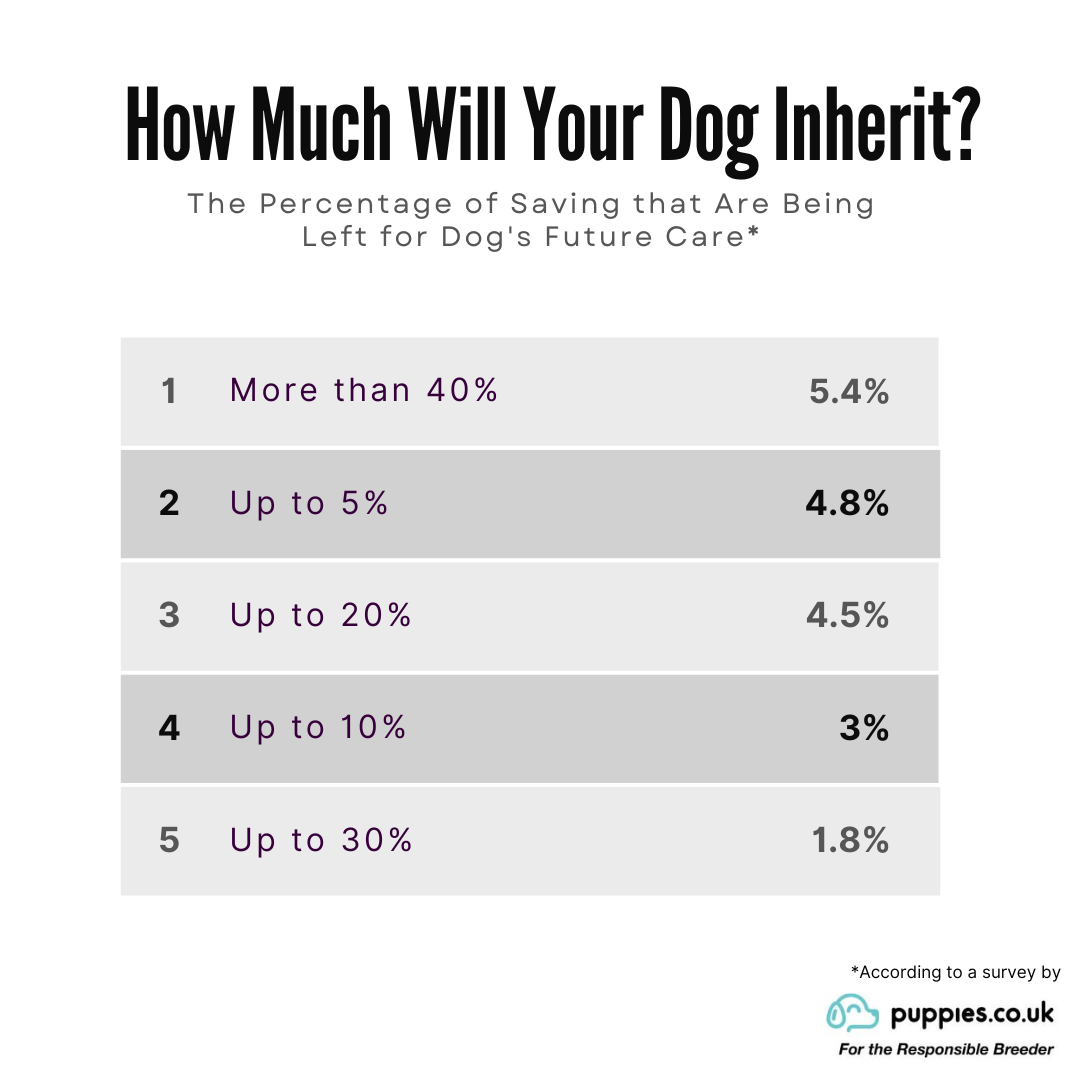

5% of dog owners have left more than 40% of their savings for their furry friend

Around 4% of dog owners say a portion of their wealth will go to an animal charity

What Plans have People Made for their Pups?

Writing a will allows you to decide what happens to your money, property and most importantly, your dogs after you pass away. However, unlike your friends and family, your dog cannot directly inherit your money. After all, your pup cannot open their own bank account or own cash. So, you would need to leave this for their future caretaker. Here are the most common plans owners make to ensure that there is no disruption in their pets’ trips to the groomer or supply of treats.

Naturally, you want to ensure that your pet is in good hands if you pass away unexpectedly. After all, your dog cannot take care of itself and will need someone to take it out on its daily walk and fill up their food bowl when it’s dinner time. 1 in 5 dog owners have already listed a caretaker for their dog in their will and also left money to help caretakers keep their cherished pets happy and healthy.

While some pet owners are only leaving up to 10% of their savings to their dogs’ caretakers (8%), others are leaving more than 40% of their wealth for their dogs’ care (5%). Data shows that, on average, Brits have around £17,365 in their savings. This means that around 1 million Brits could inherit up to £1,736.50 to protect and care for their loved ones’ pooches. What’s more, a further 650,000 potential pet parents could inherit upwards of £6,946.

Animal charities do a lot of work to support our community. They help to tip the balance away from a world that leaves dogs vulnerable to one that offers them warmth and protection. That is why around 4% of owners are giving a portion of their savings to an animal charity.

Why Owners Haven’t Mentioned their Dogs in their Wills

76% of dog owners are putting their dogs at risk by letting the law or a beneficiary decide what will happen to their furry friend. This means that many grieving families may be forced to take on the responsibility of looking after a new pet or, in some cases, have no choice but to give the dog to a shelter. If you pass away without a will or any surviving family members, your entire estate including your dog could be declared ‘“Bona Vacantia’ and be passed to the Crown. Despite this, 20% of pet owners do not think it’s necessary to add their pet will, with some saying they ‘hope’ that they will outlive their pet.

We know that day-to-day life can be pretty stressful. We all get so busy that it can be difficult to find time to do basic things like cook dinner. Add a dog in the mix and life can get really hectic. So, it’s no surprise that a quarter of dog owners say they simply have not had time to plan for their canine companion’s future.

Should I Include my Dog in my Will?

Our dogs become part of our families. But under current rules, pets are seen as property. This means that, just like all of your other belongings, your pet is considered part of your estate. That is why you need to be specific about how you want your pet to be cared for when listing them in your will.

Sure, a friend or family member may be more than happy to pet sit for a week or two whilst you are on holiday. However, they may not be willing to take on the responsibility of looking after your pup full-time.

Jack Cornes at Puppies.co.uk says: “Thinking about the possibility of leaving your dog behind is never an easy topic. But it’s something we should all consider. Our research clearly shows that many Brits are not concerned enough about their dogs, leaving a large number of dogs unprotected if anything happens to their owners.”

“Many people are simply unaware that if they die without listing their dog in their will, their pet could, unfortunately, end up in an unloved home or a shelter.”

“At the end of the day, every owner should want a say in their dog’s future. Making plans for your pet doesn’t have to be a daunting task,” he says. “You can get plenty of help and support from professional legal and financial advisors, allowing you to get your affairs in order so that your dog can continue to live a long and happy life.”

How to Put your Dog in your Will

Vera Rocha, will writing expert at Stanford Legal Services, says that including your pet in your will is something that people often forget.

“When taking instructions for wills, we always ask our clients if they have pets and what provisions should be made for them. Some pets have long life spans, or a pet might simply survive their owner in case of sudden death,” she explains. “It is important that owners give some thought and come to a decision about what is to happen to their pets after they have died.”

Qarrar Somji at Witan Solicitors says that “pet owners usually ask whether it’s possible to leave money or property to their pets in a will. Whilst it is directly not possible to do so, you can leave your pet to a friend or member of your family, together with a gift to provide for their maintenance. This can be done in several ways and it is important that a solicitor who specialises in wills and probate assists with this.”

But your dog’s new parent doesn’t have to be a friend or family member. “Interestingly, in the case of one of my clients, it was the dog walker,” Vera adds. “A fallback can be determined in case the gift fails, i.e. if the beneficiary predeceases or relinquishes the role.”

“Looking after a pet doesn’t come without incurring expenses,” she says. “Making sure the beneficiary who will look after the pet also receives a monetary gift helps ease the financial commitment.” This is a big concern with the cost of dog ownership rising. However, she notes that “the beneficiary is under no obligation to spend the gift of money on the pet.”

Option C is to set up an animal trust (a Trust of Imperfect Obligation). “This is a non-charitable purpose trust that can’t last more than 21 years, which should cover most pets’ life spans.” She notes that “setting up this trust after death comes with additional expenses as well as ongoing costs to manage the trust.”

Alternatively, you can express your wish about who to leave your pet to in a letter of wishes. “The trustees then have the flexibility to choose and alter the beneficiaries without needing to do a new will.”

“When the client doesn’t know or trust anyone to keep their pet,” she says that the final option is to gift the pet to charity. “Some animal charities run schemes for pets to be registered during their owner’s lifetime. After the client’s death, it is the executor’s task to inform the charity of the passing, who would then collect the pet and find them a suitable home,” she explains.

“The RSPCA, the Dogs Trust and the Cats Protection are charities that rehome these bereaved animals. It would be sensible to also leave a gift of money to the charity that will rehome the pet as a thank you gesture.”

Rehoming schemes for bereaved dogs:

If you are looking for more advice on keeping your dog happy and healthy, our network of reputable breeders will be happy to answer any questions you may have. Explore our listings today to speak to one of our breeders.

Methodology

Our dogs are more than just pets that share our homes. They are cherished members of our families, bringing us endless joy and affection. Including your dog in your will is not only a practical step that you should take to ensure their well-being when you are gone, but it is a reflection of how much you value and appreciate their companionship. By making sure our furry friends are provided for in our wills, we can honour the special place they hold in our hearts.

That is why we at Puppies.co.uk asked our customers about the plans they have made for their pups to encourage more owners to do the same. The survey was sent to more than 26,000 buyers and breeders registered on our platform.

The survey involved 4 questions:

Have you included your dogs in your will?

What plans have you made for your dogs in your will?

Why haven't you included a plan for your dog in your will?

How much money do you plan to leave for your dog’s future care?

We determined how much potential caretakers could inherit by looking at the UK’s dog population and the average person’s savings.

If you have any questions about this report, get in touch at info@puppies.co.uk.